harveyhaddixfan

TUG Member

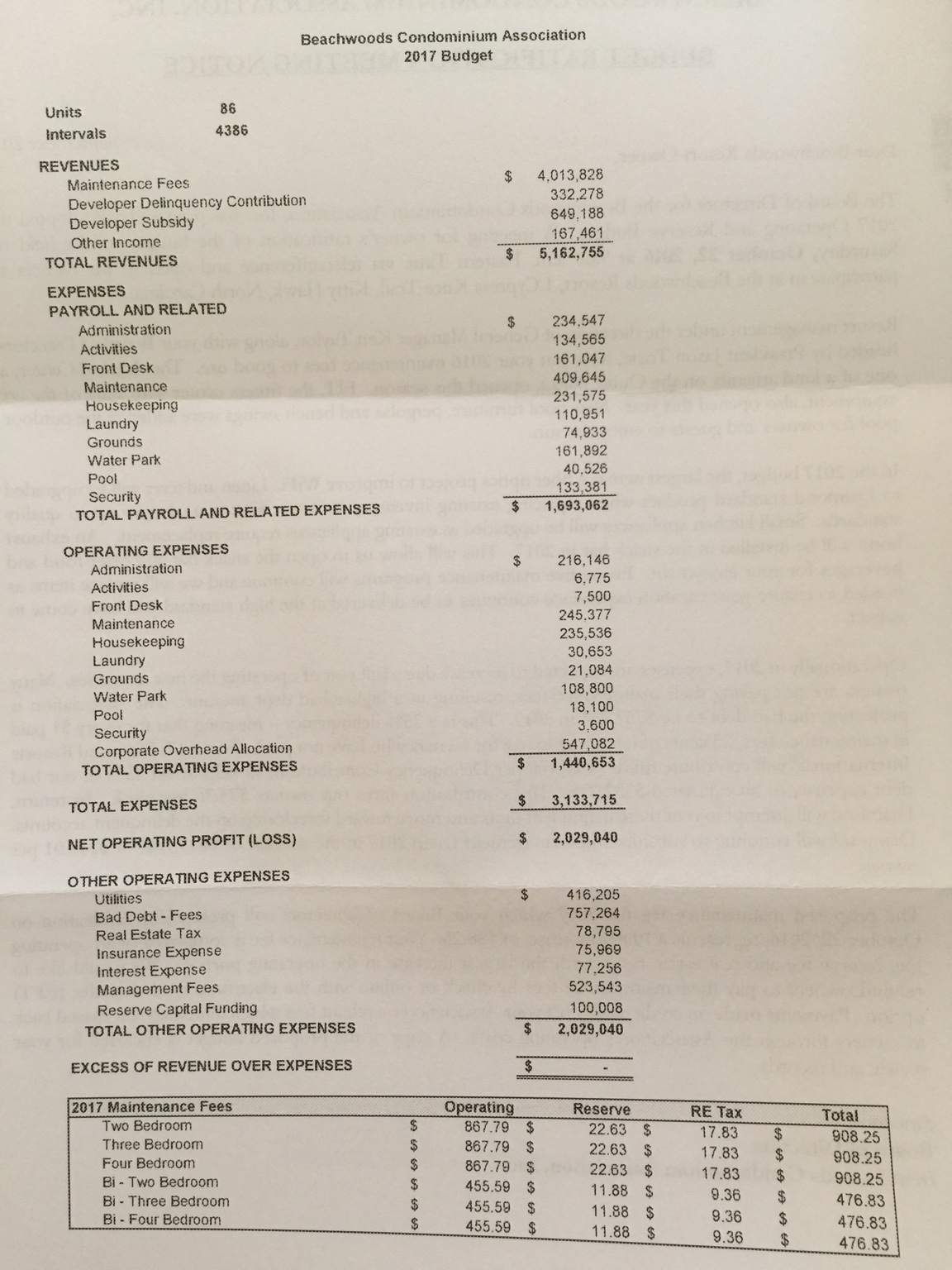

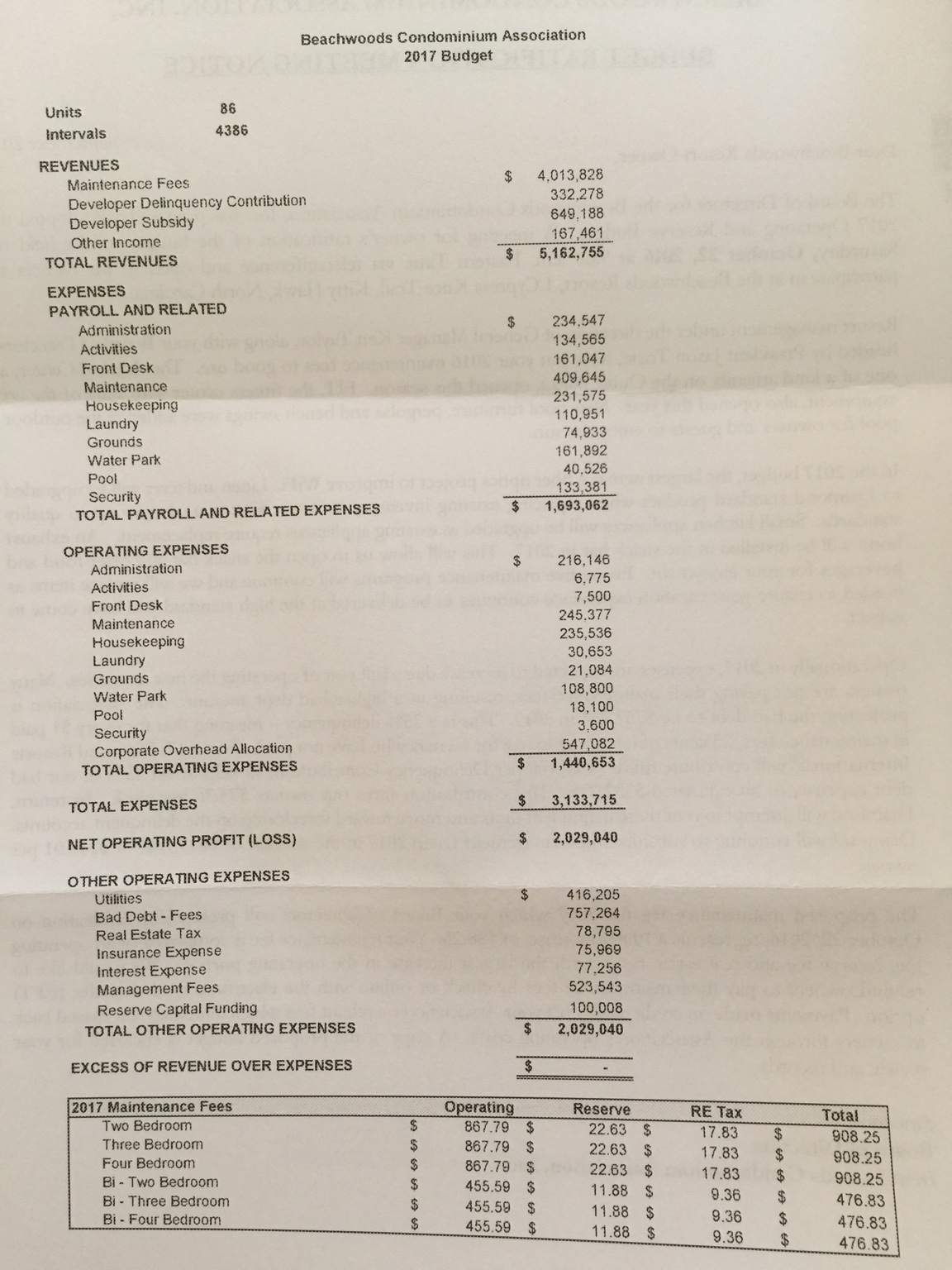

At Beachwoods in NC, the MF were approx $625 in 2014 before Gold Key took over. Then $725 ish the first year under them. After DRI took over, they jumped to $820 for 2016.

Well, Just got the HOA voting info in the mail today. Blah, blah, blah. They are raising them another 10% to $908.25. Surprise surprise.

They are saying there is a 25% delinquency or about $750k. There are 4386 intervals, with about 40-50% belonging to DRI. So that means close to half of the deeded owners aren't paying? I find that hard to believe. Even if we count it as a whole, 25% is 1096 weeks. At $820 a week, that's $899k. The math isn't adding up. A salesman must have written this letter.

Not sure what I'm going to do with this week.

Well, Just got the HOA voting info in the mail today. Blah, blah, blah. They are raising them another 10% to $908.25. Surprise surprise.

They are saying there is a 25% delinquency or about $750k. There are 4386 intervals, with about 40-50% belonging to DRI. So that means close to half of the deeded owners aren't paying? I find that hard to believe. Even if we count it as a whole, 25% is 1096 weeks. At $820 a week, that's $899k. The math isn't adding up. A salesman must have written this letter.

Not sure what I'm going to do with this week.