nuwermj

TUG Member

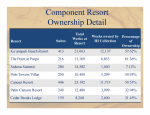

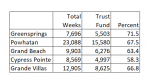

For those interested in such things, the attached table shows the distribution of points and weeks among the Diamond Resorts collections. The "Weeks" column reports the number of weeks owned by the corresponding collection while the "Points" column reports the total points generated by the collection-owned weeks. The percent distributions are distributed among the aggregate weeks and points held by collections. Weeks held outside of a collection are not included in this table.

Notes: All "weeks" data are taken from documents released by DRI. "Points" data in three rows (Factional Club in Europe, the Monarch Collection, and the Cabo Collection) are estimates. The remaining "points" data are taken from DRI documents. Individually owned deeds enrolled in (or assigned to) The Club are not included in the data. Embarc is not included because it is not an affiliate of The Club.

Notes: All "weeks" data are taken from documents released by DRI. "Points" data in three rows (Factional Club in Europe, the Monarch Collection, and the Cabo Collection) are estimates. The remaining "points" data are taken from DRI documents. Individually owned deeds enrolled in (or assigned to) The Club are not included in the data. Embarc is not included because it is not an affiliate of The Club.

Last edited: